The New Solar Tax Credit Extension For 2032

The United States Congress passed the Inflation Reduction Act of 2022 in August. In this bill, our legislatures increased and expanded the Residential Clean Energy Credit allowing more and more Americans to receive tax credits for installing solar energy systems at their homes.

The Rate Increase

Homeowners and businesses have been reaping the benefits of solar tax credits since 2006 and in recent years that rate has been 26%. With the new extension this year, the rate has increased to 30%. It will remain at 30% until 2033.

Claiming Your Solar Energy System

If you have had a solar energy system installed this year or will in the next 10 years, you will be able to claim that 30% tax credit on your income tax returns. The 30% credit applies to the total cost of the system’s components, the installation, and fees. You will need to complete a Form 5695 as part of your returns.

Quick Example

With a system that costs $30,000, your 30% tax credit would equal $9,000, reducing the complete cost to $21,000.

Requirements To Qualify

There are several requirements to qualify for this solar tax credit.

● You must purchase a new system.

● You claim your tax credit on the cost of the system’s components, installation, and fees.

● You are not leasing the energy.

● You paid for the system or received a loan for the cost.

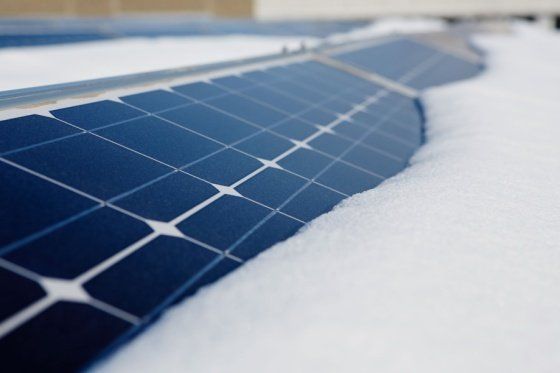

The popularity of solar energy is increasing every year and tax incentives for homes and businesses expands its benefits.

At Sunrise Solar we are specialists in saving you money with a solar system installation. Call us to set up a consultation, get a quote, and begin your solar project today!