Maximize Your Savings: Government Rebates for Solar Panels in Maryland

Tax season is upon us, and for businesses in Maryland with a solar system or those considering solar energy, it's the perfect time to explore the lucrative government incentives and tax credits available. Sunrise Solar is here to guide you through the process and help you maximize your savings.

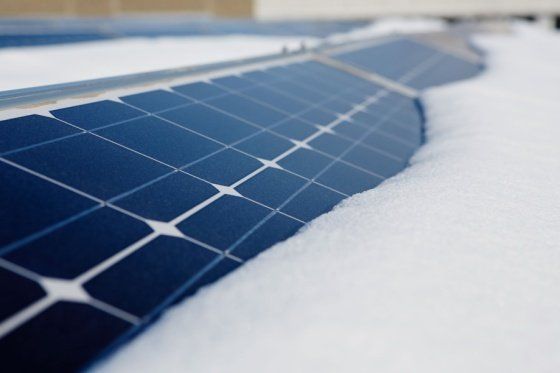

Investing in solar panels for your business not only reduces your environmental impact but also offers significant financial advantages. With a combination of federal tax credits and state incentives, you significantly reduce the cost of your solar installation and enjoy long-term energy savings.

Solar Tax Credit for Businesses: Claim Your Federal Incentives

The Federal Investment Tax Credit (ITC) is a valuable incentive for businesses that install solar energy systems. For systems installed in 2024, you can claim a 30% tax credit on the total cost of your solar project. This credit directly reduces your federal tax liability, making solar an even more attractive investment.

Government Incentives for Commercial Solar in Maryland

In addition to the federal ITC, Maryland offers several state-level incentives to further support businesses in adopting solar energy:

- Renewable Portfolio Standard (RPS): Maryland's RPS requires electricity suppliers to obtain a certain percentage of their electricity from renewable sources, including solar. This creates a market for Solar Renewable Energy Credits (SRECs), which your business can generate and sell for additional revenue.

- Commercial Solar Grant Program: The Maryland Energy Administration (MEA) offers grants to businesses for the installation of solar energy systems. These grants significantly offset the upfront costs of going solar.

- Property Tax Exemption: Maryland offers a property tax exemption for solar energy systems, meaning your property taxes won't increase due to the added value of your solar installation.

Sunrise Solar: Your Partner in Navigating Solar Incentives

We understand that navigating the complexities of government rebates and incentives can be challenging. Sunrise Solar is here to help you through the process. Our team of experts will guide you through the available programs, ensure you meet all eligibility requirements, and maximize your financial benefits.

Don't Miss Out on Solar Savings This Tax Season

As you prepare for the 2025 tax season, take advantage of the generous government rebates for solar panels in Maryland. Contact Sunrise Solar today to explore your options and discover how we help you harness the power of the sun while maximizing your financial savings.