Solar Energy Tax Incentives for Businesses

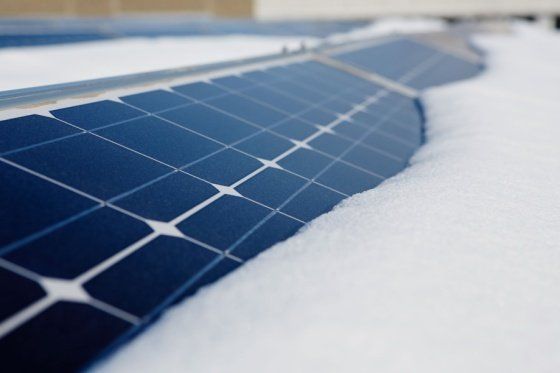

When it comes to transitioning to solar energy, many businesses choose to do so because they desire to reduce their impact on the environment and want to lower their monthly energy costs. However, these aren’t the only benefits of switching to solar. Government tax incentives can make solar energy even more appealing.

Installing a solar power system on your home is already a smart choice – but did you know that you can get even more from your system by installing a battery storage system?

Tax Credits

Investments in renewable energy — including solar panels — can qualify businesses for the investment tax credit. This tax credit directly offsets the cost of the renewable energy installation. For 2022, a permanent 10 percent tax credit has gone into effect. However, businesses that began construction on a solar project in 2021 can claim a higher 22 percent credit, even if the project has not yet been finished.

Bonus Depreciation

Tax incentives are also available regarding depreciation. Solar panels are classified as a five year property, allowing for much faster tax depreciation than would be the standard for other business upgrades. Through the end of 2022, some investments can even qualify for a 100 percent bonus depreciation, allowing for immediate deduction of this business expense. These incentives can greatly reduce after-tax costs associated with solar upgrades.

With these tax incentives, installing a solar energy system for your business can be even more cost-effective than you might expect. With these financial benefits and the ongoing gains from using renewable energy, businesses have plenty of good reasons to switch to solar!